franchise tax bd co

2015 237 CalApp4th 193 Harley I. No they send it all at once.

Please contact the moderators of this subreddit if you have any questions or concerns.

. There are 7222 searches per month from people that come from terms like franchise tax bo or similar. ISSUE Whether in a series of differing situations pass-through entity holding companies are unitary with. Franchise Tax Bd supra 10 CalApp3d at p.

I remember filing my tax return for 2015 and I had paid right on the money to CA I think I was owed a dollar or two back so. Please have your 11-digit taxpayer number ready when you call. 2009 175 CalApp4th 1346 96 CalRptr3d 864 the court upheld FTBs position that such dividends are no longer deductible under section 24402 for tax years after 1989 with the result that the maximum deduction available for those years under section 24411 is 75 percent.

The net income is to be computed by taking from the gross income as defined by section 6 of the act all allowable deductions. LEGAL RULING 2021-01 SUBJECT. Did you take the Standard Deduction on your 2019 Federal return.

The franchise tax is declared by the statute to be a tax according to or measured by the corporations net income. FRANCHISE TAX BOARD Legal Division MS A260 PO Box 1720 Rancho Cordova CA 95741-1720. The Comptrollers office has amended Rule.

IN THE SUPREME COURT OF CALIFORNIA. In California the franchise tax rate for S corporations is the greater of either 800 or 15 of the corporations net income. 502 Unity of use refers primarily to the integration and control of executive forces.

Petitioner Franchise Tax Board of California Board the state agency responsible for assessing personal income tax suspected that Hyatts move was a sham. It says FRANCHISE TAX BD DESCASTTAXRFD which google slething tells me is a CA state tax refund. W-4 IRS Withholding Calculator.

3d 457 Brought to you by Free Law Project a non-profit dedicated to creating high quality open legal information. Just checked my bank account and apparently on 9916 I had several hundred dollars deposited into my account. Franchise Tax Bd.

THE GILLETTE COMPANY et al Plaintiffs and Appellants S206587 v. Changes to Franchise Tax Nexus. Opinion for Chase Brass Copper Co.

A State Tax Refund is taxable if you itemized deductions on that prior years federal return and took a deduction for state income taxes instead of the sale tax. Subsequently in 1996 the Tax Board issued an. 14 A130803 FRANCHISE TAX BOARD San Francisco County Defendant and Respondent.

Tax using either combined reporting or separate reporting while corporations engaged in a unitary business within and without California After briefing on the cross-motions was completed the trial court stayed the proceeding until the Fourth District decided Harley-Davidson Inc. Franchise Tax Bd 138 Cal. I am a bot and this action was performed automatically.

Although Californias statute does not directly impose a tax on nonunitary income it measures the amount of additional unitary income that becomes subject to its taxation through reducing the deduction by precisely the amount of nonunitary income that the taxpayer has received. Thus in 1993 the Board launched an audit to determine whether Hyatt underpaid his 1991 and 1992 state income taxes by misrepresenting his residency. It comes from Panama.

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web. FRANCHISE-TAX-BO-PAYMENTS has been in the DB for a while it is the number 23352. 3d 892 through 1975 by respondent Mole-Richardson Company.

If the refund is less than what youre expecting from the State of CA it may be due to some kind of past due state fees parking tickets DMV courts etc and the state has adjusted the refund. Appellant Franchise Tax Board appeals from a judgment granting refund of corporate franchise taxes paid for income years 1972 220 Cal. In 1993 the respondent State of California Franchise Tax Board hereinafter the Tax Board an independent California tax agency with a statutory duty to administer and enforce the California Tax Code see Cal Rev Tax Code 19501 commenced an audit of Hyatt with respect to his 1991 part-year resident income tax return.

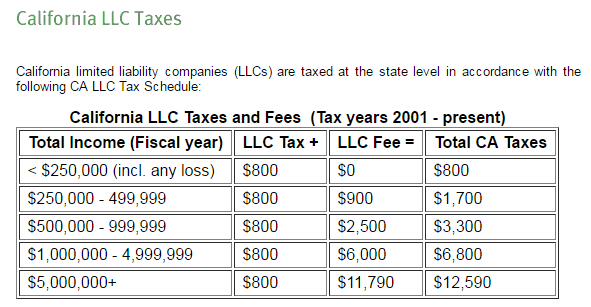

1 that CLVT had failed to comply with certain tax levies issued under a California statute thereby becoming liable for damages for such failure and 2 that in view of the defendants contention that ERISA pre-empted state law and that the. Appellant California Franchise Tax Board filed a complaint in California state court against CLVT and its trustees alleging two causes of action. For LLCs the franchise tax is 800.

504 Given that Castle executives made up the entire Hy-Alloy board of directors Castle was effectively able to control Hy-Alloy at least with respect to major policy. FRANCHISE TAX BD CASTTAXRFD 022117 XXXXX5 1600 022417 Is this something from my tax return. The question presented is whether under the factual circumstances of this case the activities of a corporation with diverse business enterprises carried on both within.

While we are available Monday through Friday 8 am-5 pm. The defendant Franchise Tax Board appeals from a judgment awarding to the plaintiff Superior Oil Company a tax refund of 50264548 including interest claimed to constitute an excess levy of the corporate franchise tax for the companys fiscal year ending August 31 1952. Chase Brass Copper Co.

For additional information see our Call Tips and Peak Schedule webpage. Unity of Apportioning Pass-through Entities. Franchise Tax Bd 463 U.

Central Time shorter wait times normally occur from 8-10 am.

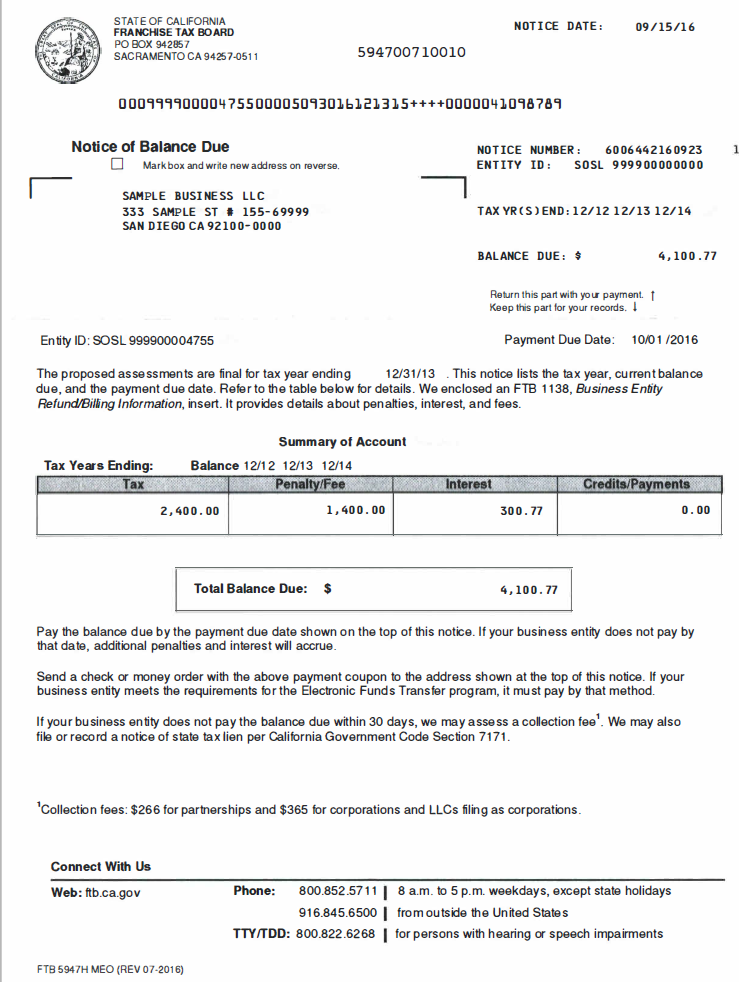

Ftb Notice Of Balance Due For Llcs Dimov Tax Cpa Services

Franchise Tax Board Homepage Tax Franchising California State

What Does Legal Order Debit Franchise Tax Board Mean Larson Tax Relief

How To Speak With An Actual Representative At The Franchise Tax Board Of California Ca Ftb Quora

California Franchise Tax Board Linkedin

California Ftb Rjs Law Tax Attorney San Diego

State Of California Real Estate Withholding Viva Escrow

The Limits Of Nudging Why Can T California Get People To Take Free Money Planet Money Npr

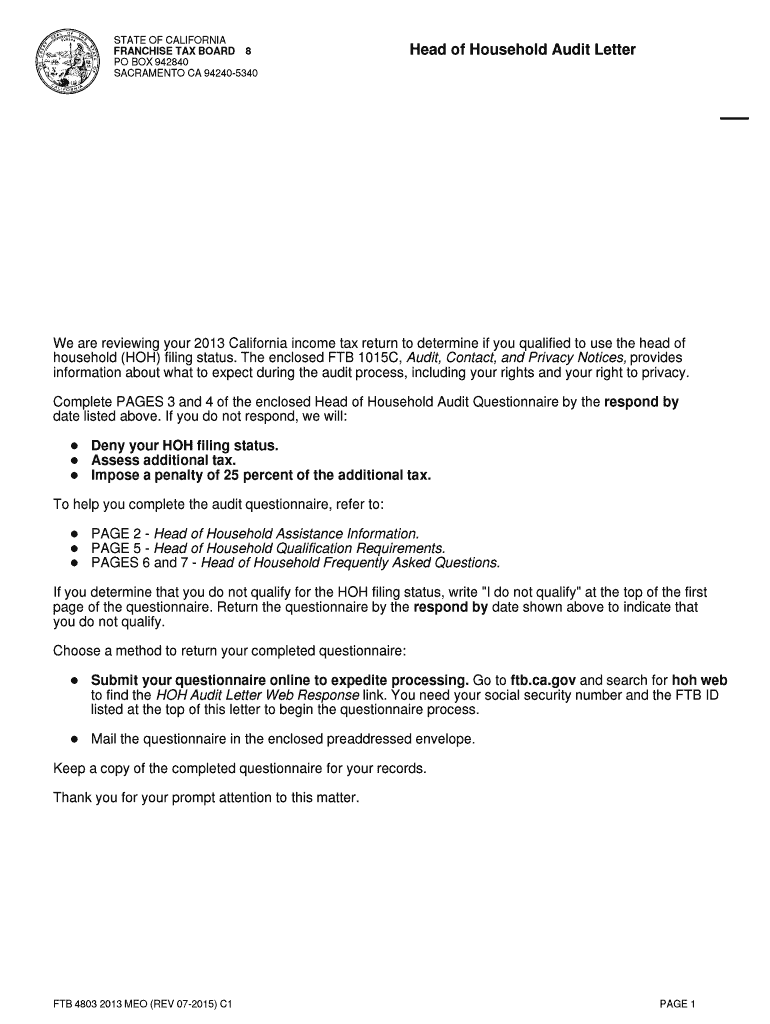

2015 2022 Form Ca Ftb 4803 Meo Fill Online Printable Fillable Blank Pdffiller

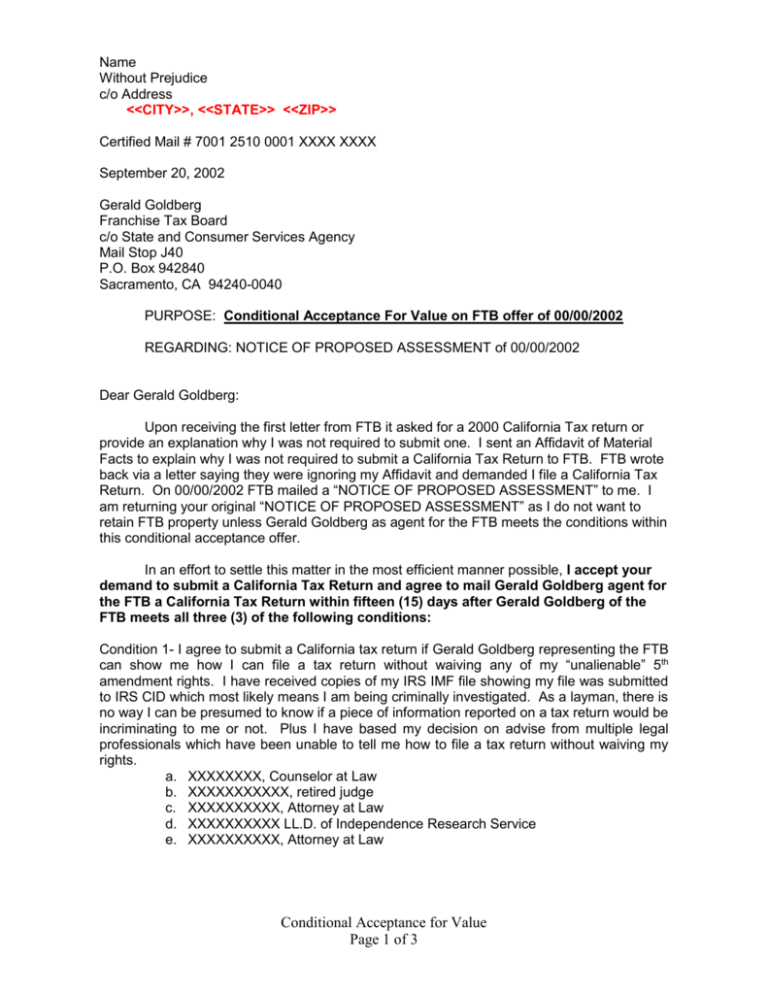

Conditional Acceptance Of Proposed Assessment

Getting A Phone Call From The Ftb Lsl Cpas

Ftb Notice Of Balance Due For Llcs Dimov Tax Cpa Services

California Franchise Tax Board Bank Levy How To Release And Resolve Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829