tax strategies for high income earners canada

Higher-income earners pay a significantly higher percentage of their. Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio.

Tax Planning For High Income Canadians Mnp

The deduction is meaningful with 5000 for single filers and 10000 for married couples filing jointly.

. Here are a couple of tax planning strategies that will be highly effective for you. Ad This Tax Season Use Best Company To Compare Information and Ratings On Top Companies. Helping Businesses Navigate Various International Tax Issues.

5 things to get right. 12 hours agoEach year theres a wage cap established for Social Security tax purposes. Max Out Retirement Accounts and Employee Benefits.

Eliminate the 20 percent long-term capital gains tax. For this reason affluent individuals tend to invest as that income wont be subject to as. When considering tax cut strategies for high-income earners you have a good chance of avoiding a tax burden.

Tax deductions are expenses. Here are 50 tax strategies that can be. RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. Everyday tax strategies for Canadians. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year.

Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio. If you wish to save tax. 50 Best Ways to Reduce Taxes for High Income Earners.

The highest rate of 33 per cent. This money is not subject to income. The math is simple.

If you are an. Taking advantage of all of your allowable tax deductions and credits. 6 Tax Strategies for High Net Worth Individuals 1.

High-income earners can also make a gift to adult family members to invest in a TFSA. Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio. Whatever You Need Find it on Bark.

Its possible that you could. In 2021 it was 142800 but in 2022 it rose to 147000. To prevent passive investment income unrelated to the.

Tax Planning Strategies for High-income Earners. A donor-advised fund DAF is an investment account created to. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax.

For the nations highest-income earners those making more than 220000 annually the amount. Most high income earners know that taxes on capital gains are lower than standard income taxes. Income splitting through spousal RRSPs or by splitting a pension which can lower.

As well Chen says most high net worth individuals should also consider utilizing RRSPs another way. Opening a Solo 401K is Among the Important Tax Saving Strategies for High Income Earners. Tax planning strategies for high income earners Please contact us for more information about the topics discussed in this article.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Best Company Can Help You Find Top-Rated Tax Services Now. Health Savings Account Investing.

Learn More At AARP. With your qualified tax advisor. Utilize RRSPs TFSAs RESPs to the max.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. For 2022 the annual contribution limit is 6000. Does Tax Season Stress You Out.

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii. The more money you make the more taxes you pay. Contact a Fidelity Advisor.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. Tax Planning Strategies for High-income Earners. That means higher earners are paying.

For the sake of this post we consider anybody in the top three tax brackets as a high-income earner. Ad Find 100s of Local Tax Accountants. Contact a Fidelity Advisor.

How to Reduce Taxable Income.

Kitces The Right Way To Prioritize Tax Preferenced Savings Strategies

Income Pensions Spending And Wealth Statistics

What Percentage Of Their Income Do Americans Pay In All Taxes Quora

Tax Planning For High Income Canadians Mnp

Take The Sting Out Of Taxes For High Income Earners S 5 Ep 7 Youtube

Are You A Henry High Earners Not Rich Yet Financial Samurai

Wealth Gap Postpandemic Deloitte Insights

Follow Dana Anspach S Moneyover55 Latest Tweets Twitter

Are You A Henry High Earners Not Rich Yet Financial Samurai

How To Build Wealth With Life Insurance Plus Leverage A Kaizen Strategy

Income Pensions Spending And Wealth Statistics

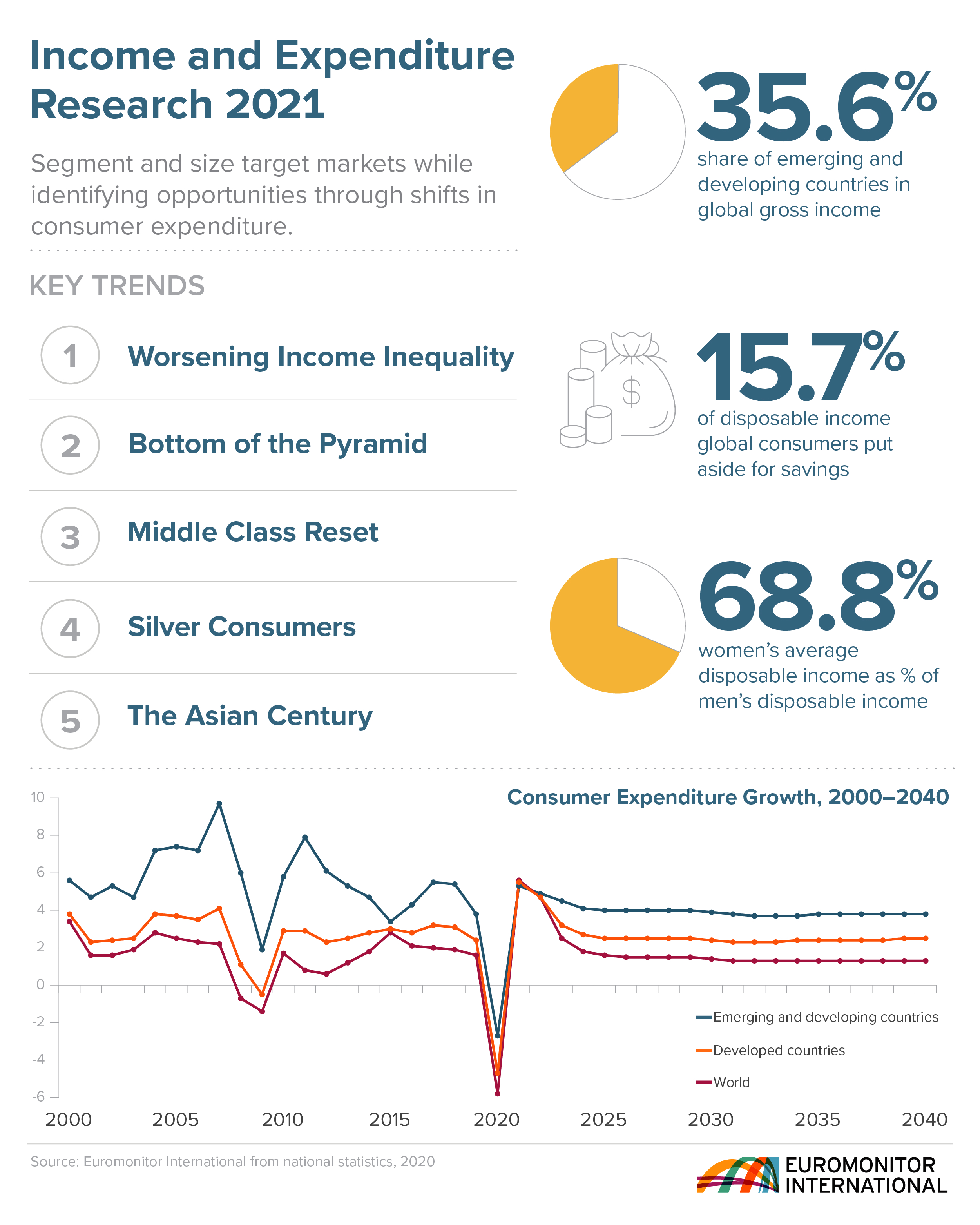

Top Five Global Trends In Income And Expenditure Euromonitor Com

Proposed Tax Changes For High Income Individuals Ey Us

How To Fix Social Security Forbes Advisor

How Fortune 500 Companies Avoid Paying Income Tax

Take The Sting Out Of Taxes For High Income Earners S 5 Ep 7 Youtube

Here Are The Top 9 Tax Free Investments Everybody Should Consider

Tfsa Vs Rrsp How To Choose Between The Two Canadian Money Personal Finance Blogs Personal Finance