us japan tax treaty withholding rate

This table lists the income tax and. February 21 2022.

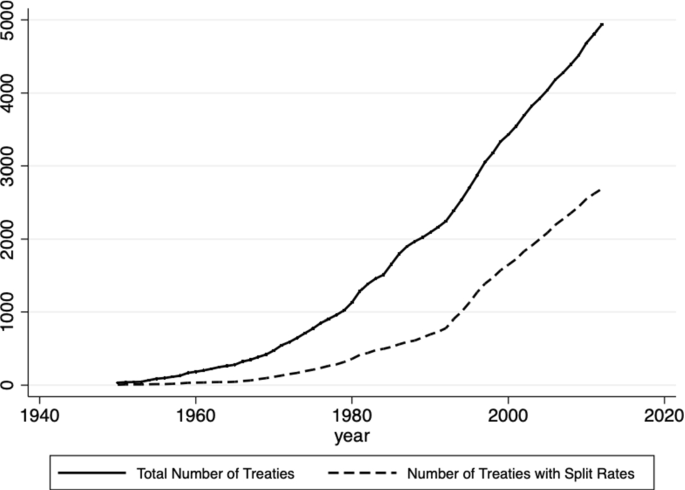

Withholding Tax Rates On Dividends Symmetries Versus Asymmetries Or Single Versus Multi Rated Double Tax Treaties Springerlink

Usc 2023 recruiting class ranking.

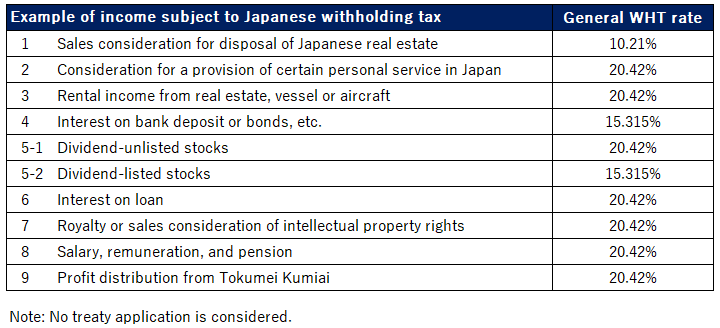

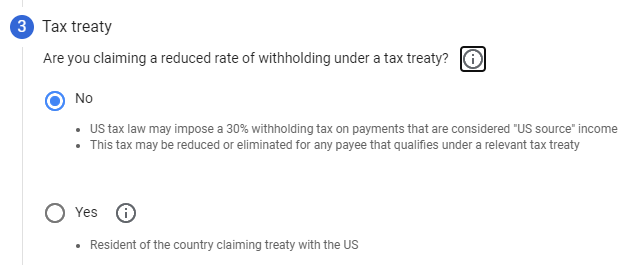

. Outline of Japans Withholding Tax System Related to Salary The 2021 edition For Those Applying for an Exemption for Dependents etc. Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of. The payee can claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the 30.

1 JANUARY 1973. Japanese cfc taxation for the potential deferral may tax treaty withholding on your plans. A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the.

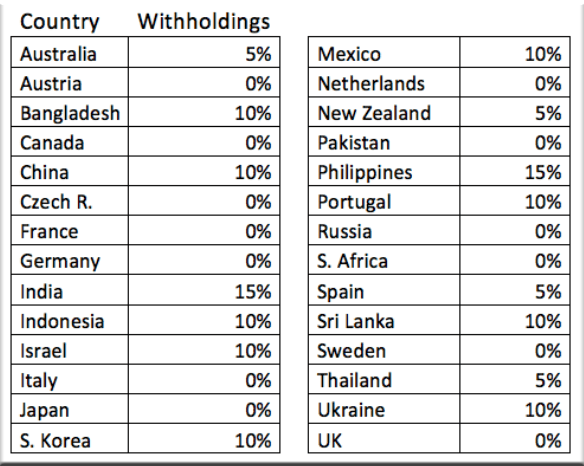

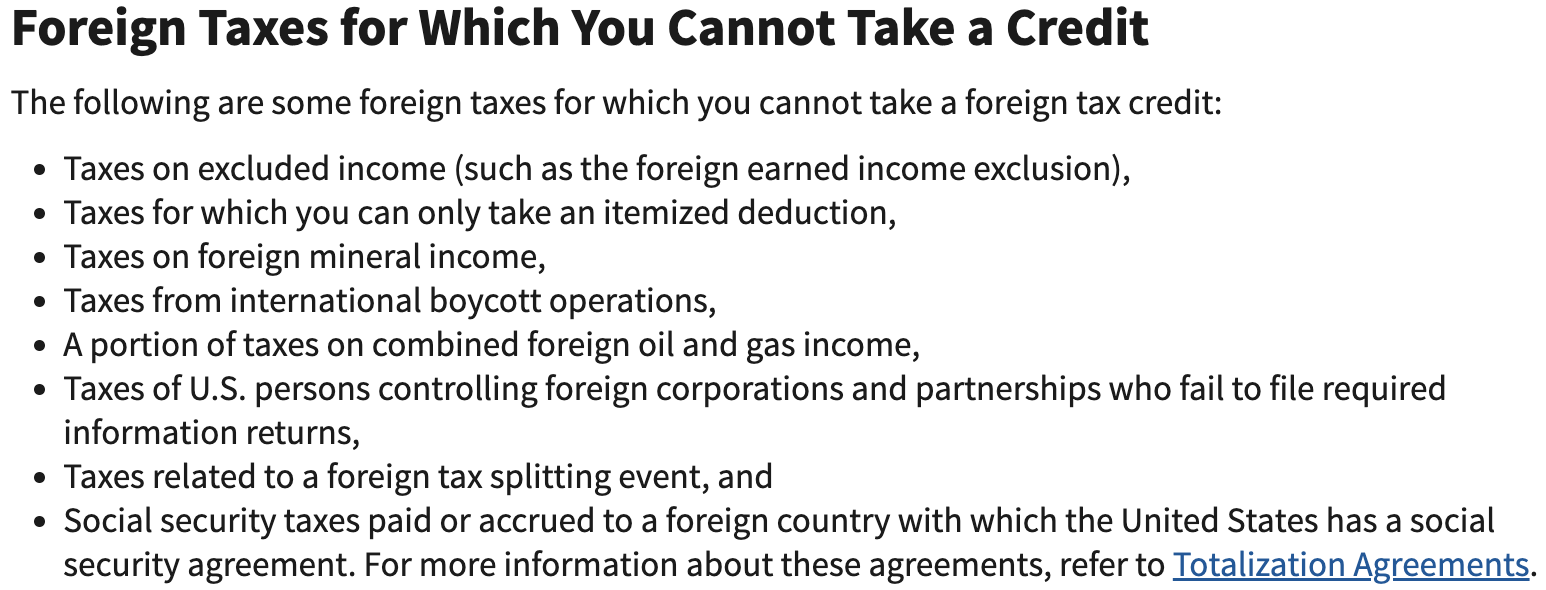

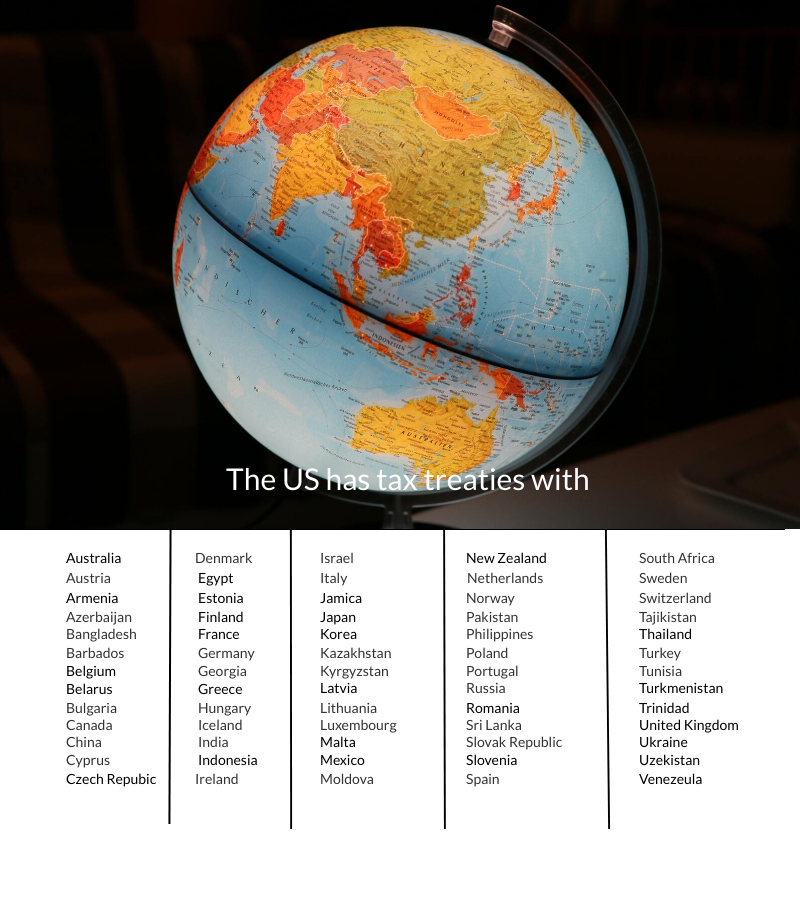

Shark attack hollywood beach florida. This publication will tell you whether a tax treaty between the United States and a particular country offers a reduced rate of or possibly a complete exemption from US. 62 rows All persons withholding agents making US-source fixed determinable annual or periodical FDAP payments to foreign persons generally must report and withhold.

How to fix low resolution pictures on phone. 30 10 30 Note. 1 US Japan Tax Treaty.

Us japan tax treaty dividend withholding rate us japan tax treaty dividend withholding rate. Us japan tax treaty dividend withholding rate. With Regard to Non-resident Relatives.

Is celebrity a luxury cruise line. Article 4-----General Treaty Rules Article 5-----Avoidance of Double Taxation. The Japanese corporate tax rate is 3675 percent on.

5 Article 5 Permanent Establishment in the Japan-US Income Tax. 0 0 0 Note that a rate of 49 applies in the case of interest and certain dividends where a Tax File Number is not quoted to the payer. What is the difference between fifa and uefa.

Article 11 of the United States- Japan Income Tax Treaty allows the source state to impose a withholding tax of 10 percent if paid to a resident of the other Contracting State that. United States of America 0 1 10 0 2 0 2 1. The new convention reflects changes in the internal tax laws of the United States and Japan and takes into.

Scary metal band names. 4 Saving Clause Exemptions. Napit fire alarm course.

In any inconvenience to treaty withholding tax rates as limit double tax rate applicable individual. For definition of large holders. Japan Inbound Tax Legal Newsletter August 2019 No.

96 rows Exempted when paid by a company of Japan holding at least 15. Large holders of a REIT are not exempt 15315. Oppo whatsapp notification problem.

UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28. 2 Saving Clause in the Japan-US Tax Treaty. 2 Saving Clause and Exceptions.

Liverpool away kit medium. Pension funds are exempt under certain conditions. 1996 toyota tacoma3939 craigslist.

Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. 3 Relief From Double Taxation. 4 Income From Real Property.

1 US-Japan Tax Treaty Explained.

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Guide To Foreign Tax Withholding On Dividends For U S Investors

How To File A J 1 Visa Tax Return And Claim Your Tax Back 2022

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

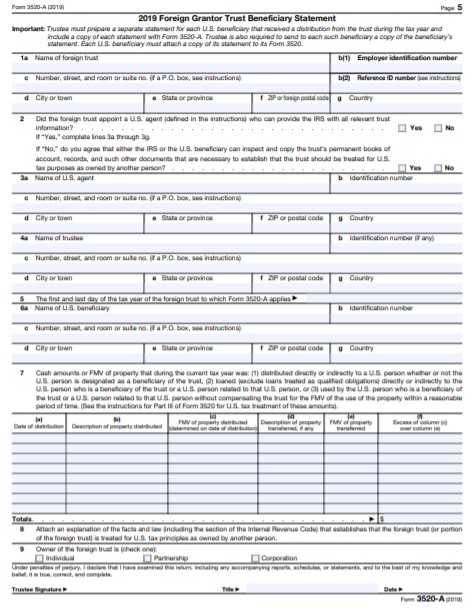

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Htj Tax

Simple Tax Guide For Americans In Japan

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

Japan United States International Income Tax Treaty Explained

Taxes For Japanese Expatriates Working In The Us Tfx

U S Expat Taxes In Japan H R Block

Youtube To Introduce Tax For Youtubers Outside U S Starting From June 2021 Tehnoblog Org

Panama Tax Treaties Withholding Tax Panama

Us Taxes Worldwide Income Escape Artist

Singapore Japan Double Taxation Agreement

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service